This is the first chapter of Benjamin Graham’s The Intelligent Investor. I believe it is one of the more important chapters in creating a basic principle to follow as one invests: How to discern investing intelligently and speculation.

What is investing intelligently?

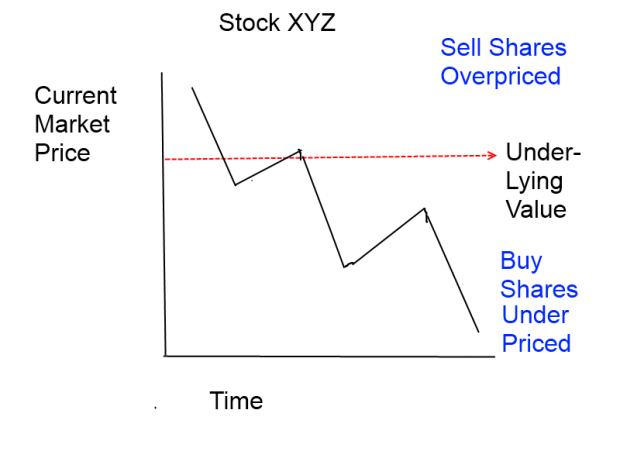

Benjamin Graham makes a pretty good argument for what it means to be investing intelligently. It means to be a disciplined person when dealing with investments. Not to be swayed by market conditions and to have confidence in your judgement of whatever stocks you are investing in. To do hard and thorough research on companies to find their underlying value and to buy them.

What is speculation or speculative investments?

Speculation is any in investment operation when you think you are investing. Basically, it is investing without doing your own work or not forming your informed opinion (not following an investment strategy). It would be the equivalent of always following what the media is saying, as to where the market is going. If the media says the market is going to be bullish, you invest all of your money in the market. If the media says the market is going to bearish, you sell when stock prices are falling. This is one of the more illogical things one can do, sell when the price of the stock is going down. Why would you sell a stock that is worth more than its market value says? For instance, you may believe stock XYZ is worth twenty dollars a share. However the current market price is falling drastically, because the media says “we are in a recession” or the “DOW prices fall drastically” or something similar to that. Does this mean that company XYZ is worth less? Well not necessarily. It depends on how the business is handling itself during a recession. Market conditions could have a direct effect on the underlying value of XYZ. If the company sells some of its assets to increase cash holdings or something that decreases its underlying value, then yes maybe the current market price is correct. It is your job as an Intelligent Investor to be able to discern everything that is happening with company XYZ.

Now that is my interpretation of what Speculation is. Benjamin Graham says its anything that isn’t Intelligently Investing. Speculation does have its role in the market though. It allows a stock to rise to its value in some instances, to become well known. For instance whenever a company goes public, its IPO will probably more then likely be bombarded by Speculative investors. Eventually the stock should reach its value. This allows a start-up company to get into a healthy range for its underlying value and to expand. It can help create a good healthy buy or a sour one. Also it allows someone to sell an increasingly risky asset to someone else. It allows risk to easily be exchanged across the market.

There are a couple more important things I would like to highlight. Speculation is only bad if you as an investor are speculating more than you are investing intelligently. If you are speculating with only 5% percent of your total investments, you may be able to afford the losses. Its all relative according to your financial situation. Its just a matter of finding a good point where you can be confident in your investments. By this I mean, not having to check your stocks at current market price constantly.

Leave a comment